SCDigest Says: |

he majority of respondents report that, while they have achieved substantial material and labor cost reductions through outsourcing, most have yet to see significant reductions in process or management costs. he majority of respondents report that, while they have achieved substantial material and labor cost reductions through outsourcing, most have yet to see significant reductions in process or management costs.

Click Here to See Reader Feedback

|

A recent survey of some 350 supply chain executives from across the globe by the consultants at PRTM identified five key supply chain challenges for the next few years. Successful management of those challenges, the resulting report says, will be central to a company’s ability to capture benefit from an eventual economic upturn.

Those supply chain challenges are:

Trend 1: Supply Chain Volatility and Uncertainty Have Permanently Increased: Market transparency and greater price sensitivity have led to lower customer loyalty. Product commoditization reduces true differentiation in both the consumer and business-to-business (B2B) environments.

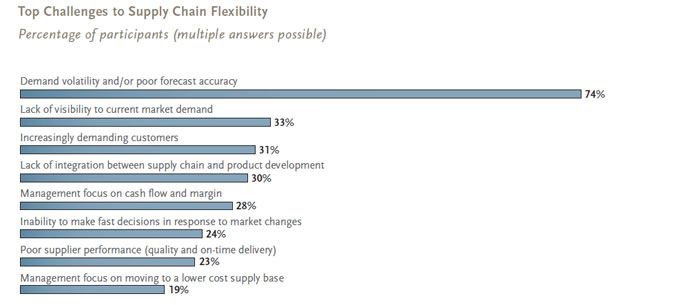

Increasing volatility is a major issue. The report says that some 75% of respondents consider demand and supply volatility and poor forecast accuracy to be the biggest supply chain roadblocks they currently face. (See chart below.)

The increased commoditization of products plays a key role here, even beyond the demand volatility associated with the recession. With an increasing ability and willingness of customers to find alternative supply sources, B2B customer demand can move up or down dramatically and rapidly.

“Customer loyalty has significantly decreased in the past 12 months,” said one industrial manufacturer participating in the study.

What are companies doing to manage this volatility?

“Companies are focusing primarily on deepening collaboration with key customers to reduce unanticipated changes in demand,” the report says. “Half of participants plan to implement joint “real-time” planning with their key customers by 2012, and nearly half plan to develop processes for improved demand sensing—that is, understanding the market rate of demand in real time, rather than having to wait for after-the-fact reporting.”

Source: PRTM Report

Trend 2: Securing Growth Requires Truly Global Customer and Supplier Networks: Future market growth depends on international customers and customized products. Increased supply chain globalization and complexity need to be managed effectively.

Most survey participants expect that future business growth will come primarily from new international customers and/or products that are customized to meet customer needs. “As a result, more than 85% of companies expect the complexity of their supply chains to grow significantly by 2012,” the report says.

Interestingly, the survey found that while most companies expected growing complexity in the number and location of customers and in SKU counts and product variants, the majority expects a decrease in the number of manufacturing locations, primarily due to outsourcing, and in the number of suppliers they work with.

“Regionally configured supply chains will be the key to success,” the report suggests. “These supply chains serve regional customers according to their requirements, while bundling supply chain partners, manufacturing facilities, and distribution centers as much as is economically possible.”

Trend 3: Market Dynamics Demand Regional, Cost-Optimized Supply Chain Configurations: Customer requirements and competitors necessitate regionally tailored supply chains and product offerings. End-to-end supply chain cost optimization will be critical.

Survey respondents expect gross margins to increase over the next two years, not from better pricing power but – as is always the case it seems – from further reductions in supply chain costs.

Improved globalization of the supply chain and still more outsourcing were viewed as the main two levers to reduce supply chain costs.

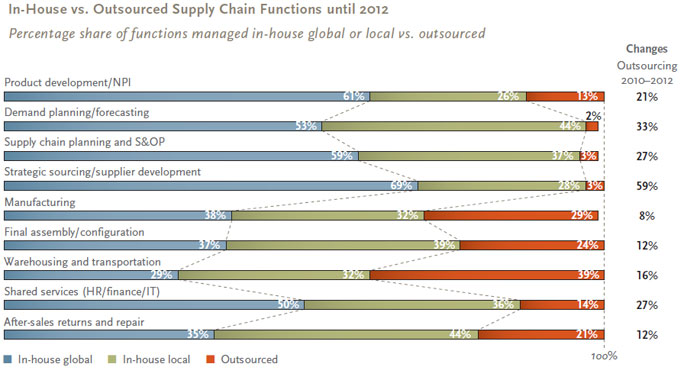

The chart below is a good one, showing what supply chain related functions are done internally, either at a local or global level, or outsourced, as well as the percent change expected in outsourcing between 2010 and 2012.

Source: PRTM Report

But companies with large expectations for savings from outsourcing need to be careful – “The majority of respondents report that, while they have achieved substantial material and labor cost reductions through outsourcing, most have yet to see significant reductions in process or management costs,” the report notes.

(Supply Chain Trends and Issues Article - Continued Below)

|