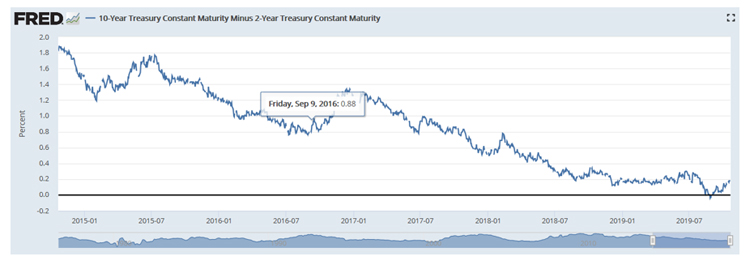

Economic recessions occur about every nine years which means the next one is already overdue. A very good leading indicator of an imminent recession is the interest rate spread between the 10-year and 2-year U.S. Treasury bond. Historically within two years after this spread drops below zero the economy goes into a recession. The spread dropped below zero on Aug 29, 2019 and has recovered a bit since then, but that leading indicator was breached. A majority of economists predict the next recession will hit by the 2020 election. JPMorgan, for example, says there is a 60% chance of recession by 2020 and 80% by 2021.

Source: Federal Reserve Bank of St. Louis, Economic Research (https://fred.stlouisfed.org/)

Canitz Says... |

|

| Advanced analytics capabilities have matured greatly in the past 10 years to take advantage of Big Data and powerful computers. The ability to quickly display and analyze data in both numerical and graphical formats enables fast and optimal decision making. |

|

What do you say? |

|

| Click here to send us your comments |

|

|

|

Today, most supply chain leaders personally experienced the turmoil of the 2008 recession. However, with close to 10 years of solid growth those lean years following the last recession are but a distant memory. After all, growing a business creates its own sets of demands on supply chains and who has time to worry about a potential economic crash when you are running as fast as you can to keep up with growth? In a 1948 speech to the British House of Commons, Winston Churchill slightly paraphrased a quote by George Santayana saying, “Those who fail to learn from history are condemned to repeat it.” Did your company learn from the 2008 recession and is your supply chain ready for the next recession?

Where is S&OP?

For some supply chain operations, the 2008 recession came as a surprise. Why? Weren’t they running a Sales & Operations Planning (S&OP) processes to balance and align supply and demand? The answer is likely, yes. However, there was a disconnect between this monthly process and strategic long-term planning. Today, we still find that operational, tactical and strategic planning processes tend to operate independently, based on their individual assumptions and data, run by different people and enabled by different systems. These independent processes create plans in different aggregations and time-horizons. Often longer-term planning isn’t based on what is actually happening in the supply chain and shorter-term planning does not reflect strategic decisions. To anticipate and be ready for the next recession, all three planning horizons need to be aligned and synchronized. Integrated Business Planning (IBP), or as some call Advanced S&OP, helps you plan across multiple horizons with incredible speed and precision that wasn’t even thought possible 10 years ago. The ability to combine volumetric and financial information may help provide an early indication to market changes. (Read “The Advanced S&OP Checklist” to learn more.)

Data Rich, Information Poor

The number of data sources and corresponding data continues to grow exponentially. The data that was available 10 years ago is only a fraction of that which is available today. What data should we focus on to spot a potential downturn? How do we manage that data? The reality is many companies today are data rich and information poor. We have more data than we can humanly manage and analyze. Since the 2008 recession there have been great strides made in capabilities to interface with and manage the enormous volumes of structured and unstructured data. We can now visualize what is happening, run scenarios on what could happen and determine how ready we are for potential changes. Some companies have started on a supply chain digital transformation to ensure end-to-end supply chain information is captured, visible and usable. (Read “The Keys to Creating and Leveraging Actionable Information” from Peerless Research Group to learn how supply chain executives view the role and need for analytics.)

The Role of Artificial Intelligence

How can we use all of the data available to help determine if a recession is imminent? One approach is to gather a team of data scientists and analysts together to pour over hundreds of spreadsheets exported from various enterprise systems, syndicated data sources and unstructured data streams. This complex and time consuming process means the event will likely have happened before you can prepare and evolve your business processes appropriately. The use of Artificial Intelligence (AI) provides the ability to sort through the mountains of available data and determine what is relevant. Through Machine Learning and Deep Learning we can start to make connections and predictions. As with IBP and data management capabilities, AI has come a long way in the past 10 years. Today, advanced supply chain and analytics platforms contain AI capabilities that help you quickly find the nuggets of truth and use that information to make more accurate short, mid and long-term predictions. Where is your company on its journey of adopting AI capabilities? Should the threat of an overdue recession lend more urgency to your AI initiatives? (Explore more in the ebook, “The Role of Machine Learning in Supply Chain Planning.”)

Analytics to Align the Product Portfolio

Many companies were caught with too much inventory at the beginning of the 2008 recession. Customers stopped buying and even cancelled orders causing a ripple effect up the supply chain. Consumer buying preferences changed to favor lower feature, lower cost products. We saw private labels grow while the previously lucrative premium markets dried up. In a growing economy we often see product proliferation to meet the growing demands of niche buyers who are willing to pay more. It is important now to look at product portfolio rationalization so you can quickly refocus on the most profitable items during the onset of the next recession. Advanced analytics allow us to quickly understand the profitability of products and, through the use of Big Data and AI, we can predict which products are likely to suffer as consumer spending power dwindles. The ability to display and analyze data in both numerical and graphical formats enables fast and optimal decision making. (Learn more in the white paper, “Building a Successful Supply Chain Analytics Foundation”)

A 30% Inventory Reduction is Possible

Companies were also left holding too much inventory of the wrong type and/or in the wrong location. This isn’t unique to a recession but its negative impact is compounded in a down economy when you are trying to reduce costs in every way possible. Multi-Echelon Inventory Optimization (MEIO) is a proven solution to help optimize inventory across your end-to-end component, WIP and finished goods inventory stored in a network of manufacturing, distribution and retail locations. This can all be modeled and optimized in a matter of minutes. Considering demand and inventory variability, MEIO can determine where each item should be kept and how much is required to meet agreed upon customer service levels. Further, MEIO allow you to set service levels by SKU, location and customer to take advantage of today’s advanced supply chain segmentation capabilities. Through our work with customers around the world, we have seen MEIO produce a 30% or more reduction in total network inventory while maintaining or improving customer service levels. In a growing or contracting economy, results like that can really impact your business. Like advanced IBP systems, MEIO enables powerful “what-if” scenario modeling to evaluate options and mitigate risks. MEIO also automates inventory parameter updates to enable fast adaptation to changing market conditions. Has your company implemented a modern inventory optimization solution? What’s 30% of your total working inventory worth? (Continue your education with the ebook, “The Inventory Optimization Handbook.”)

No one is likely to predict exactly when the next recession will happen. That being said, there is a pretty good chance of a recession over the next 18 months. Are you ready or are you willing to wait and risk the impact to your supply chain? As Churchill said, “Those who fail to learn from history are condemned to repeat it.” Don’t repeat it. Make sure to take the lessons learned from 2008 combined with the advances in technology to help you weather the storm and come out even stronger.

What can your company due in the next 18 months to get ready? Start the discussion with your team, with your executives and map out a course to success.

Logility can help. Logility provides the only Digital Supply Chain platform that enables autonomous supply chain planning from product Concept to Customer availability. The Logility platform leverages Artificial Intelligence, Machine Learning and Advanced Analytics to help you make smarter decisions, faster. We help our customer turn data into information for lower costs, higher revenue and better customer service.

About the Author

Henry Canitz is the Product Marketing & Business Development Director at Logility. To read more of Henry’s insights visit www.logility.com/blog.

Any reaction to this Expert Insight column? Send below.

Your Comments/Feedback

|