Our first reaction here at SCDigest was: how can this be? The notion of dramatically declining ROA while productivity has increased many fold on the surface does not make sense – companies should be getting more value out of each asset.

That’s before other factors that should be also driving ROA higher, such as:

- Increased use of outsourcing/offshoring, which should be reducing a company’s asset base, and the goal of improving ROA is often a driver of those types of outsourcing decisions.

- The supply chain focus of many companies on improving ROA as a key performance metric. As an example, in the mid-2000s, office products retailer Staples decided to focus its supply chain goals around one key metric, Return on Net Assets (RONA), a similar measure which divides income by fixed assets plus working capital.

- Effective corporate tax rates for most US firms have dropped substantially since 1965 – by some 13% on average.

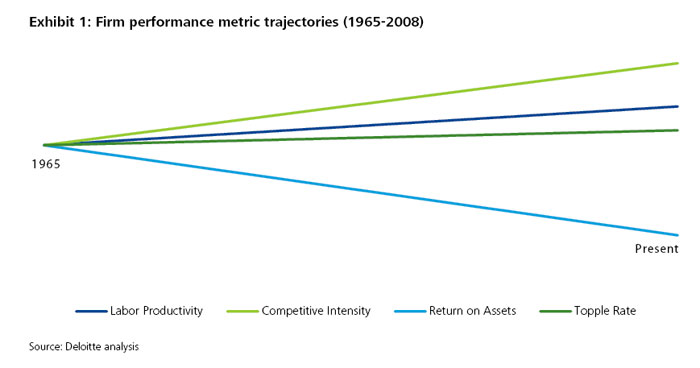

For its part, Deloitte says that “that gap in performance between winners and losers has increased over time, with the “winners” barely maintaining previous performance levels, while the “losers” experience rapid deterioration in performance.”

It further says that while the ROA of the financial sector has been especially poor over this period, affecting the overall results, the ROA trend is occurring across most of the 15 industry sectors evaluated.

It also says that what it calls the “topple rate,” or the pace at which big companies lose leadership positions, has more than doubled, meaning it is hard to stay on top for long.

Deloitte also says that much of the productivity gains have simply been lost to increasing competitive intensity, which it says has doubled over the past 40 years.

We need more time to really analyze this here, as this data actually is somewhat troubling, in some ways.

If anyone has any insight to share on this, we would welcome the input.

Are you too surprised at these ROA trends for US companies? Is there something wrong in the statistics? How would you explain what is happening? Let us know your thoughts at the Feedback button below.

SCDigest is Twittering!

Follow us now at https://twitter.com/scdigest |