|

For the last several years, SCDigest has partnered with the smart analysts at Gartner on a major supply chain survey, and again this year we would like to highlight the results.

The survey was done at the end of 2010, the findings issued a couple of months ago, and we just found a spot for it this week. The survey data is based on responses from about 300 SCDigest readers.

Gilmore Says: |

Those of us closely tied to the technology side of supply chain tend I think to consistently over-emphasize the level of penetration of different supply chain technologies, as survey after survey attests. Those of us closely tied to the technology side of supply chain tend I think to consistently over-emphasize the level of penetration of different supply chain technologies, as survey after survey attests.

Click Here to See

Reader Feedback

|

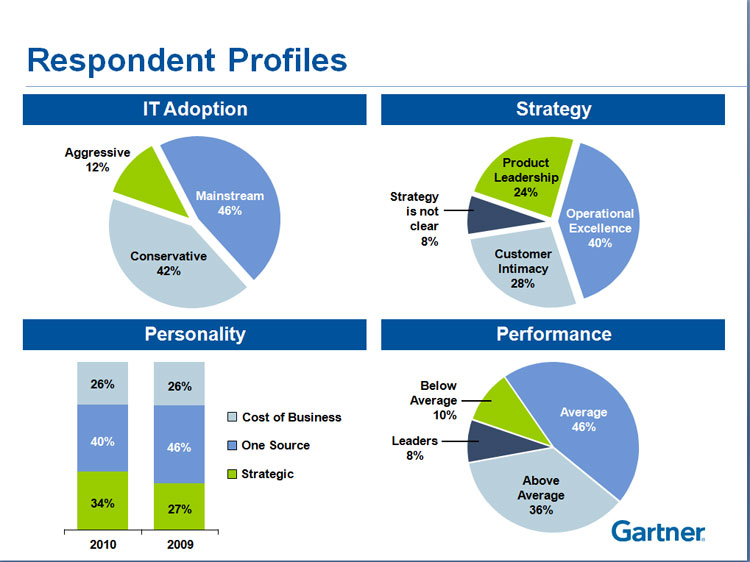

Survey reports typically start with various charts indicating the profile of the survey population,just to provide some insight into who was answering the questions, but we thought one of these charts was interesting on its own. Gartner asked a series of questions that tried to profile the respondent company's supply chain "personality," as seen in the chart below.

For example, 34% say they consider supply chain the leading source of their company's competitive advantage, 40% identify SCM as one of several sources, and 26% that see it as largely a commodity function.

8% of respondents see themselves as supply chain leaders, and another 36% believe they have above average performance. 46% see themselves as average, and 10% believe they have below average supply chain performance.

We see here a little bit of what I have called "the 50% problem" before, with the number of companies believing they are above average or leaders 4.5 times higher than those thinking they are below average, when of course the percents have to be equal in reality. But the fact that 46% believe they are average is likely a more accurate perception.

Finally, 12% of respondents say their companies are aggressive adopters of supply chain technology, versus 42% who say they are conservative. The rest (46%) say they are "mainstream." One of the report authors, Gartner's Dwight Klappich, tells me however that those companies identifying themselves as supply chain leaders were much more likely to also describe themselves as aggressive SCM technology adopters. Ponder that for a minute, as well as how your supply chain would fall in these personality categories.

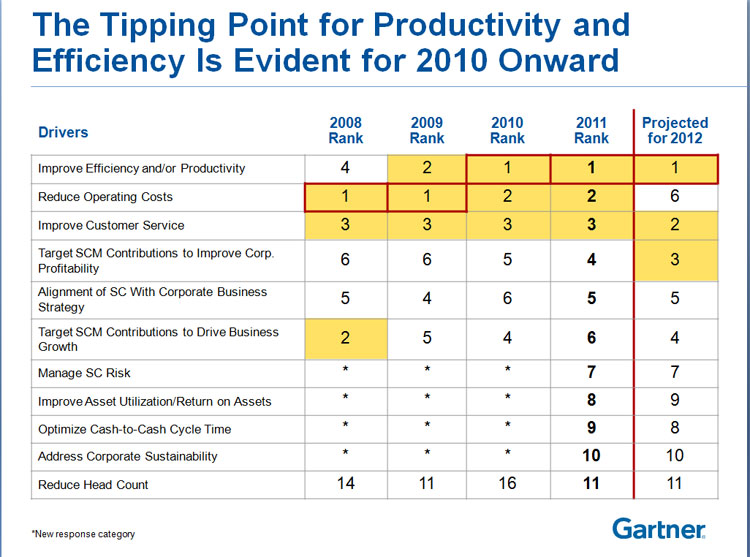

The headline news from the results in a sense is that for the second straight year, improving supply chain productivity and efficiency topped "cost reduction" as the number 1 supply chain priority, as shown in the chart below. Cost reduction was number 2, followed by improving customer service. Of course, improving productivity/efficiency is closely related to reducing costs, but Klappich believes there is an important difference.

"As the recession hit, companies used a lot of "brute force" cost cutting in the supply chain, but it wasn't sustainable," he said. "Now, just like last year, as the economy somewhat recovers with hopes for better times ahead, the focus is on growing the top line but reducing overhead by not growing headcount at the same rate, or even to pre-recession levels. That, of course, is one factor in the poor jobs environment in the US."

Interesting, however, is the fact that actually reducing headcount was an extremely low priority - near the very bottom. Companies don't want to reduce staffing levels further, it seems, they just want to add it back very slowly if at all.

Gartner projects cost cutting will fall all the way to number 6 in terms of SCM priorities next year. I think that is unlikely, but the state of the economy and top line growth will be key factors in the rankings.

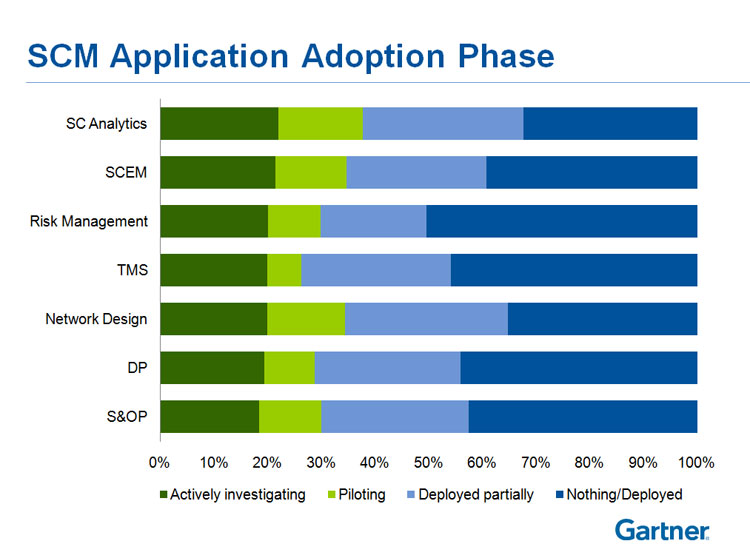

I also find interesting each year the chart that shows where companies are in terms of supply chain technology adoption. Those of us closely tied to the technology side of supply chain tend I think to consistently over-emphasize the level of penetration of different supply chain technologies, as survey after survey attests.

As shown below, for example, almost 50% of respondents (which included a high percentage of larger firms) said they had yet to deploy an advanced transportation management system (TMS). A similar percentage have not deployed a focused demand planning system. More than 40% say they have not deployed Sales & Operations Planning, though whether this means as a process or as supporting technology is not clear.

Other highlights of the 2011 study:

- Interest in sustainability is waning. It scored very low on one question related to SCM priorities. Conversely, dealing effectively with increasing government mandates scored very high on the priority list.

- Dealing with supply chain complexity is a dominant concern for companies, but Klappich says supply chain leaders view it somewhat differently. "Leaders are much more likely to believe they can manage complexity to their competitive advantage," he said. "Others are afraid of it."

- Plans for spending on supply chain technology increased this year versus the previous two, and the overall IT spending profile closely resembles the fairly bullish one seen in 2007. As an aside, Klappich tells me right now Gartner is fielding lots of calls for companies looking for WMS and/or TMS.

All told, a very interesting study. We will add one more chart as our graphic of the week next week (heck, you are supposed to be a paying Gartner client to get this stuff). I also hope you can participate in the next survey late this year.

Any reaction to the Gartner study data? Is there an important difference between a focus on cost cutting and productivity/efficiency? Do the SCM technology adoption numbers surprise you? Let us know your thoughts at the Feedback button below.

|